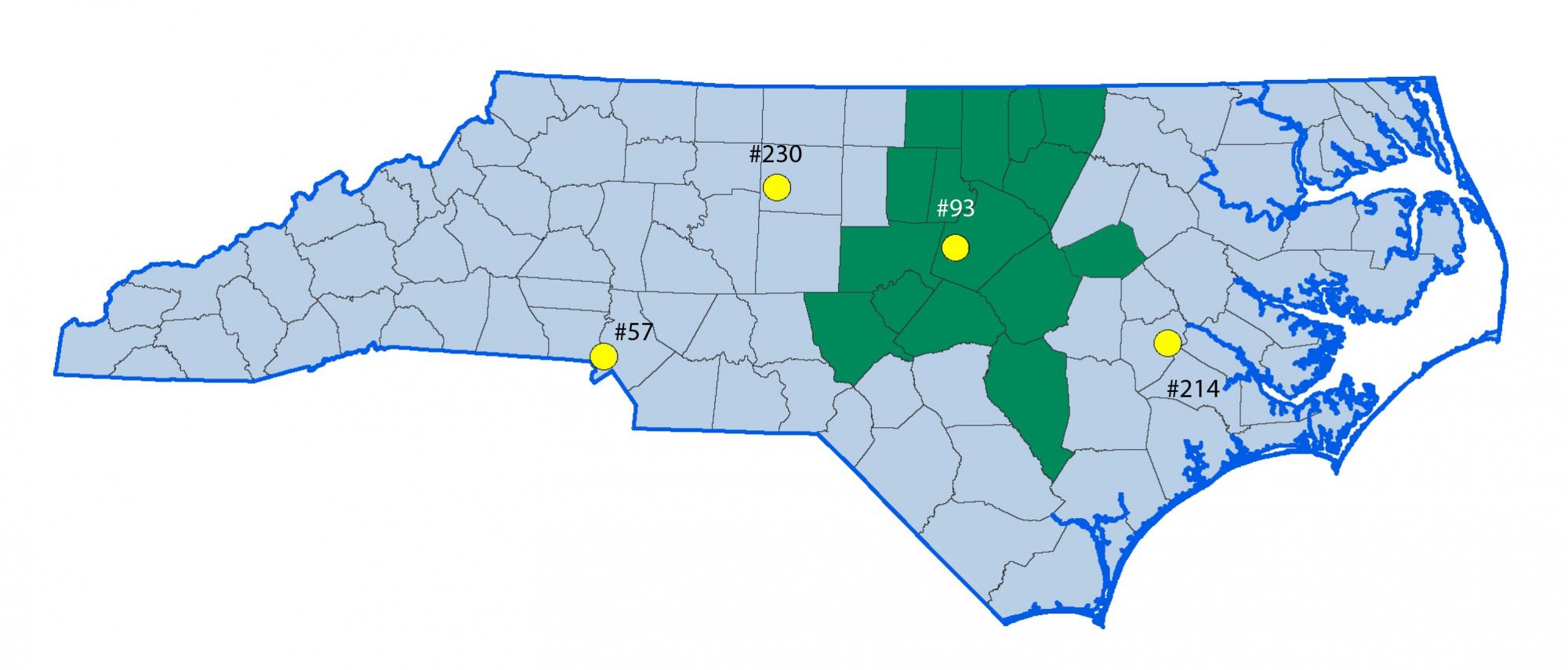

CPRC is the grantee of the Research Triangle Area's full-service, multi-site Foreign Trade Zone #93 which allows companies importing and exporting products to reduce or delay custom duties or taxes on products received within the zone. The zone spans 15 counties, including Chatham, Durham, Franklin, Granville, Harnett, Johnston, Lee, Moore, Orange, Person, Sampson, Vance, Wake, Warren, and Wilson counties.

All businesses within the zone's boundaries are eligible to join the program. Businesses that conduct extensive importing or exporting of products may benefit extensively.

Current FTZ #93 Sites

Site 6 - GlaxoSmithKline (Wake County)

Site 8 - Tobacco Rag Processors, Inc. (Wilson County)

Site 9 - AISIN North Carolina Corporation (Granville County)

Site 10 - TransPacific Suppliers Alliance (Wake County)

Site 11 - Liebel-Flarsheim Company, LLC (Wake County)

Site 12 - Storr Office Environments, Inc. (Wake County)

Site 13 - Amazon.com Services, LLC (Johnston County)

Site 14 - BrightView Technologies, Inc. (Durham County)

Subzone 93C - Merck Sharp and Dohme Corporation (Wilson County)

Subzone 93G - Revlon Consumer Products (Granville County)

Subzone 93H - Merck Sharp and Dohme Corporation (Durham County)

Subzone 93J - MAS ACME USA (Chatham County)

Foreign Trade Zone Benefits to Businesses

Duty Exemption: No duties or quota charges on re-exports (exception applies for exports to Canada and Mexico under NAFTA). By using a Foreign-Trade Zone, the company avoids the lengthy Customs duty drawback process. No duty is paid on goods destroyed in the zone, which can benefit a company with fragile imports or with manufacturing processes that result in large amounts of scrap.

Duty Deferral: Customs duties and federal excise tax deferred on imports until they leave the zone and enter the U.S. Customs territory. (Zone merchandise may move in-bond, Zone-to-Zone transfers without payment of duty.) Unlike bonded warehouses or temporary importing under bond programs, there is no limit on the length of time that merchandise may remain within the Zone, whether or not duty is owed.

Duty Reduction (Inverted Tariff): Where zone manufacturing results in a finished product that has a lower US Harmonized Tariff rate than the rates on foreign inputs, the finished product may be entered into the U.S. Customs territory at the duty rate that applies to its finished condition. Moreover, duty is not owed on labor, overhead or profit attributable to zone production operations.

Merchandise Processing Fee (MPF) Reduction: MPF is only paid on goods entering the U.S. Customs territory. Zone users are able to file a single entry for all goods shipped from a zone in a consecutive seven-day period instead of one entry file for each shipment (excluding merchandise subject to live entry). MPF fees are charged at 0.3464% of the Total Estimated Value (TEV) of the shipment, with a minimum fee of $27.23 and a maximum fee of $528.33 per entry. Fewer entry filings can also reduce Brokerage fees.

Streamlined Logistics: Upon approval from Customs, imports may be directly delivered to the zone. Users may also request permission to break and affix Customs seals. A single entry may be filed for seven consecutive days’ worth of entries and exports.

Quota Avoidance: In most instances, imports subject to quota may be retained within a Foreign-Trade Zone once a quota has been reached allowing zone users access to potentially discounted inputs and the ability to admit merchandise as soon as a new quota year starts. Additionally, except for certain textiles, inputs subject to quota may be manipulated or manufactured while in the zone into a product not subject to a quota.

How Much Can Your Company Save Through the FTZ?

Calculator not loaded. Please visit the Rockefeller Group FTZ Calculator instead.

Rates, Tariff, and Legal Review Board

The FTZ #93 Rates, Tariff, and Legal Review Board serves as an advisory committee to help oversee the operation, administration, and public utility nature of FTZ #93 and make appropriate recommendations to the TJCOG Board of Delegates. Below is information about our current Board Officers:

OFFICERS

Chairman: Thomas J. White – Director, Economic Development Partnership, in the office of Research, Innovation and Economic Development, NCSU. His current appointment to the FTZ Board is through December 2023 and as Chairman through December 2021.

Vice Chairman: Bill Haiges – Town of Siler City Commissioner and delegate to Triangle J Council of Governments. His current appointment is through December 2024 and as Vice-Chairman through December 2024.

MEMBERS

Steve Brantley – Orange County Economic Development Director. His current appointment is through December 2023.

Lori Bush – Town of Cary Council Member and alternate delegate to Triangle J Council of Governments. Her current appointment is through December 2024.

Bo Carson –Triangle North Executive Airport, Director. His current appointment is through December 2023.

Chris Johnson – Johnston County Economic Development Director. His current appointment is through December 2024.

Ivan T. Kandilov – Associate Professor in the fields of International Trade, Development and Labor Economics, Department of Agricultural and Resource Economics, North Carolina State University. His current appointment is through December 2022.

Harry Mills – Granville County Economic Development Director. His current appointment is through December 2024.

Rebecca Wyhof Salmon – City of Sanford Councilor and delegate to Triangle J Council of Governments. Her current appointment is through December 2021.

Angie Stewart – Harnett County Economic Developer. Her current appointment is through December 2024.

Michael L. Weisel – Managing Member of Capital Law Group. His current appointment to the FTZ Board is through December 2022.